Faster Insights.

Better Analysis.

Greater Confidence.

Designed for institutional investors, Reflexivity combines trusted data from S&P Global, LSEG Datastream, Cboe, Nasdaq, and more with explainable AI to surface insights - not noise. No separate data contracts required.

The Future of Investment Analysis

Advanced AI capabilities designed specifically for institutional investment workflows.

Autonomous financial analysis

Deep Research

Generate comprehensive investment analysis in minutes. Our AI agent writes and executes code to answer complex financial questions with institutional-grade accuracy.

How it worksConnected Market Intelligence

Knowledge Graph

Explore interconnected market relationships and insights through our dynamic knowledge graph. Uncover hidden connections between companies, themes, and market events.

How it worksReal-time Portfolio Analysis

Portfolio Insights

Get instant insights into your portfolio's performance, risk metrics, and exposure analysis. Our AI-powered platform provides comprehensive analytics and actionable recommendations.

How it worksAdvanced Market Simulations

Scenario Analysis

Model complex market scenarios and stress test your portfolio with AI-powered simulations. Understand potential outcomes and make data-driven decisions with confidence.

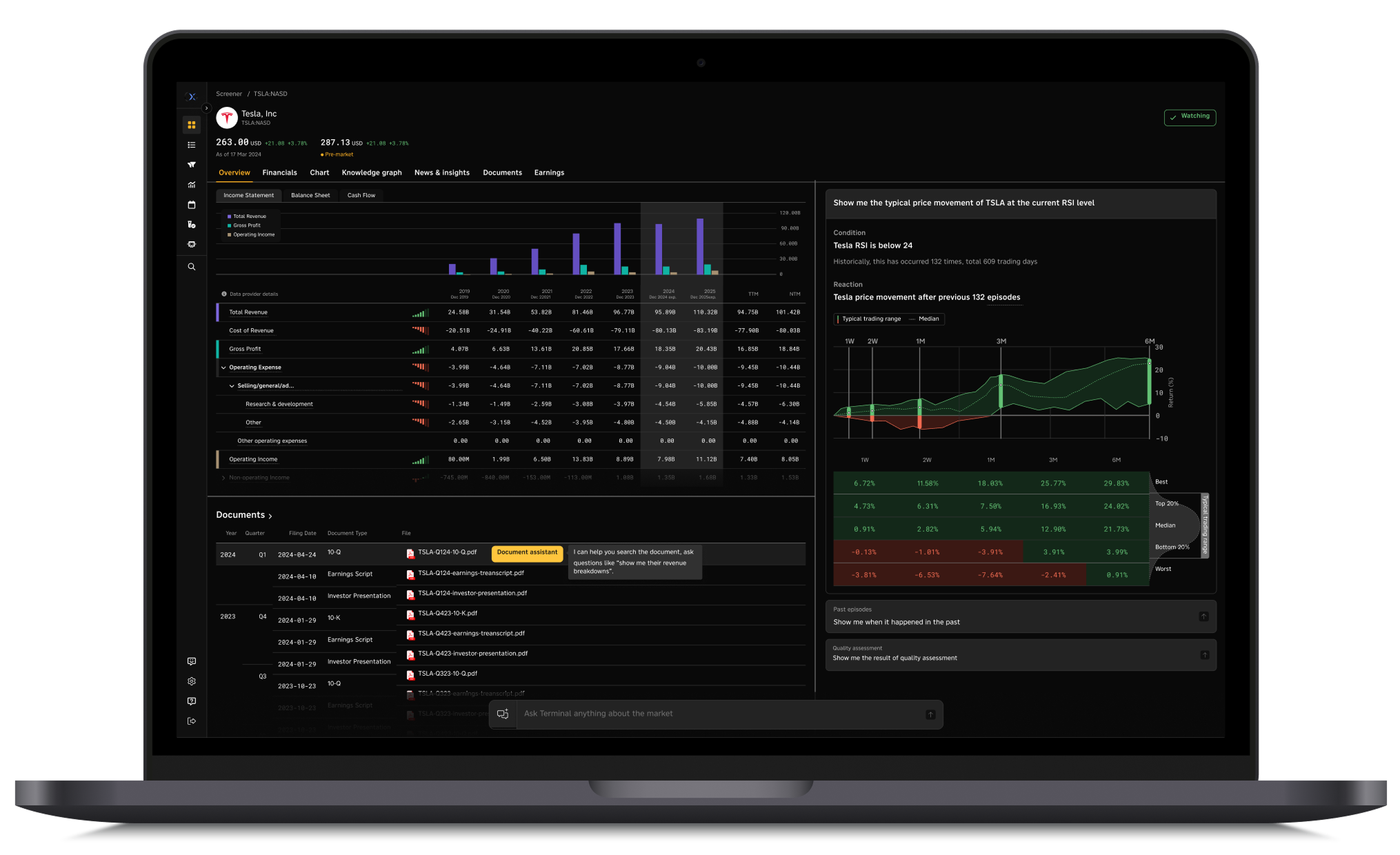

How it worksSEC filings & earnings analysis

Document Intelligence

Extract insights from thousands of financial documents instantly. Analyze SEC filings, earnings transcripts, and investor presentations with advanced OCR and NLP.

How it worksIntelligent Market Scanning

Smart Screening

Discover investment opportunities with AI-powered screening that analyzes market patterns, government trades, and market sentiment in real-time.

How it worksTrusted by

Leading Investors

Enterprise Security & Compliance

Bank-grade security and compliance for institutional investors.

Verified Data Sources

Exclusively uses institutional-grade data from Refinitiv, Nasdaq, and S&P.

No Hallucination

Engineered to acknowledge limitations. When data is unavailable or uncertain, the system explicitly states so.

Auditable Analysis

Every insight traceable to source data with quality ratings. Full audit trail for compliance requirements.

SOC 2 Type 2

Annual third-party audits. Proven security controls meeting institutional DDQ requirements.

Data Isolation

End-to-end encryption with no persistent storage of client data. Complete isolation between clients.

Private Infrastructure

Dedicated compute resources. Air-gapped from public AI models and consumer services.

Comprehensive, High-Quality Data

We source financial, market, and macroeconomic data from leading global providers.

Solutions for Every Institution

Whether you need a complete platform or API integration, we have the right solution for your firm.

Platform Access

For Investment Teams

Full access to Reflexivity's web platform with all AI capabilities and premium features.

Complete AI suite

Knowledge Graph insights

Unlimited document search

Advanced scenario analysis

Real-time portfolio alerts

API Integration

For Technology Teams

Integrate our AI capabilities directly into your existing systems and workflows.

RESTful API access

Custom model deployment

White-label options

Real-time data feeds

Technical support

Built by investors, for investors

Led by a team of former portfolio managers and technologists from leading financial institutions.

"We started Reflexivity to build the market platform I wished I had while managing a $15B global macro book."Jan Szilagyi, CEO