Dec 12

preview

I cannot remember an instance in recent financial history when a concerted easing action by all major global central banks, including EM, wasn’t met with a positive response from financial markets. Add fiscal stimulus to the mix and it’s really not surprising that equity markets are powering higher. However, a lot of commentators are anticipating a recession in 2020.

So, will this time be different?

To be sure, there are a few new elements at play this time around. A trade war between the US and China is new and difficult to quantify. And so are the geopolitical tensions in the Middle East and Russia. All this is hurting confidence and is showing up in a lack of investment spending.

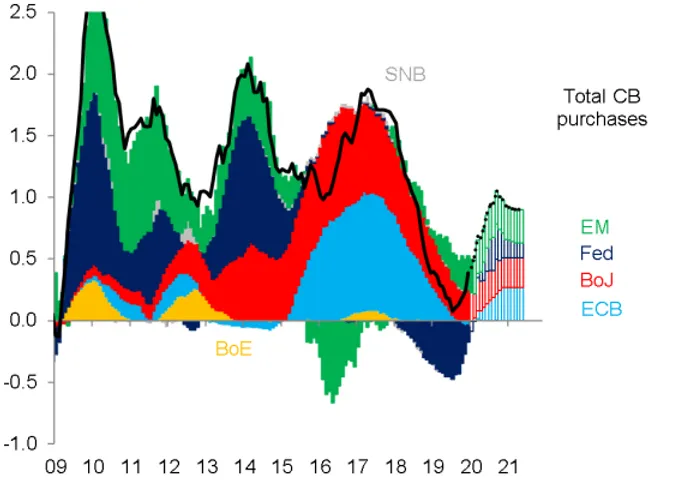

Figure 1 shows that the floodgates have opened again and in the coming months CB purchases of financial securities will reach levels similar to those seen earlier in the decade since 2008.

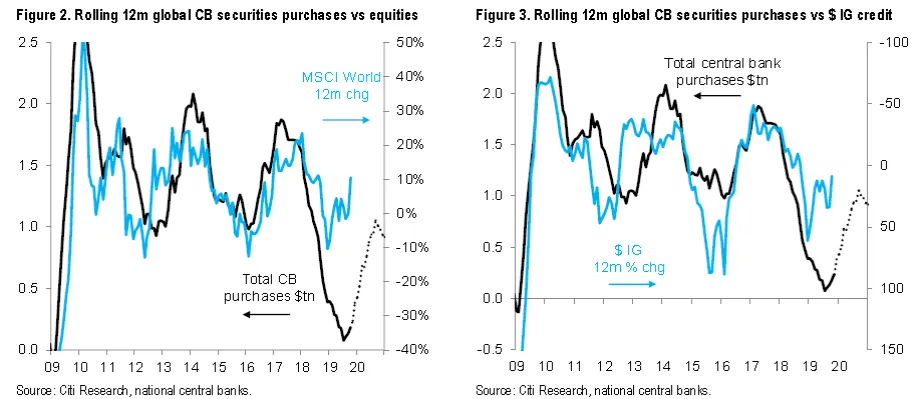

Similarly, figures 2 and 3 show that every time since 2008, a monetary tsunami swept share prices up.

A recession in 2020 ought to be a very remote risk whilst the global economy enjoys the tailwinds of easy monetary policy and fiscal expansion in some countries. As we head into another round of liquidity pouring into global financial markets, it’s therefore difficult to see equities selling hard short of a systemic market issue, or a major escalation of the trade war going on between the US and China. Best to fasten your seat belts and hang on to risk assets for a while longer.

Up Next

Dec 12

preview