Dec 12

preview

There’s a famous story that goes around among commodity traders. It revolves around the fact that certain futures contracts deliver the physical commodity once they reach maturity. Someone shows up at your door and says: “here’s 15,000 pounds of orange juice solids”.

In the story a junior trader forgot to unwind his Live Cattle contract and got delivery of a few hundred cows on Wall Street. The ticker is LE on CME, if you’re interested. Each future is for 40,000 pounds (~18 metric tons)...of live cows. How many cows is that?

Typically just over a dozen, courtesy of commodity.com.

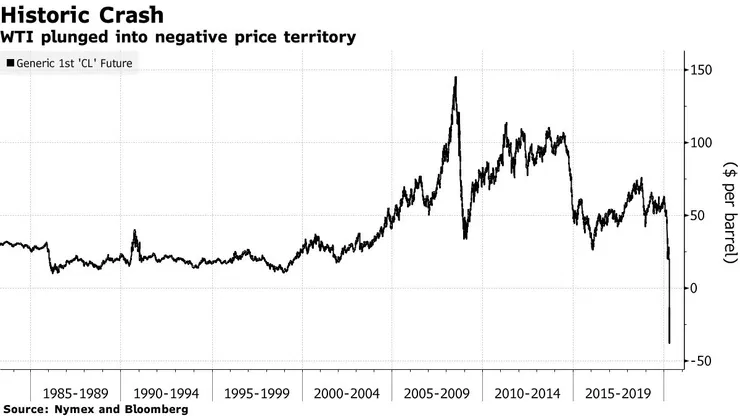

Whilst the story is clearly apocryphal, the need to manage physical delivery for futures contracts is real. Yesterday the oil trading community gave us a magistral lesson in its unintended consequences. On April 20th 2020, the May WTI Oil future crashed for a moment to $-40.37 due to a conjuncture of macroeconomic and technical factors.

That’s right. That means exactly what you think: “here, I will pay you $40 to take this barrel off my lawn”. A mix of weak demand, no vacant storage, and loaded longs in the first future forced traders to a simple choice: accept delivery of millions of barrels of oil, or sell at any cost.

It feels like WTI makes history every day in 2020

The macroeconomic implications are fairly clear, the world is experiencing a massive glut of supply with no demand to soak it up. And whilst stocks might be ebullient, commodities beg to differ about the state of the economy. At times, large market shocks engender even larger after-shocks. On the first trading day of 2016 China opened down 8%, dragging other markets along on a -20% ride. One wonders the impact of negative oil on global markets that just recovered 50% of what will become the “Corona Virus Crash”. At the same time, the Federal Reserve has just injected $3tn in the economy and traders who have lived through QE1, QE2 and QE3 are obviously wary of shorting markets and being caught in a squeeze. To express a bearish view with a diversified approach, we put together a basket of our best bearish AI-generated ideas, mixing diverse investing styles. Here are four bearish ideas for investors and four bearish trades for traders.

Workhorse Group (WKHS:NASD) - driven by Weak EPS Revisions

First Western Financial (MYFW:NASD) - driven by Expensive Valuations

Proteostasis (PTA:NASD) - driven by Falling Growth Expectations

We post them each day in our newsletter. You can subscribe here.

Party City (PRTY:NYSE) - driven by Weak Entry-Point

Vivint (VSLR:NYSE) - driven by Excessive Momentum Rebound

Verisign (VRSN:NASD) - driven by Price Topside Resistance

Coda Group (CODA:NASD) - driven by Bearish Technical Analysis

Whether the markets experience a recovery or a complete reversal, these two baskets seek to stack the odds in favour of bearish investors and traders, based on all available data to today.

Feeling bullish instead? Believe that the Fed and the other Central Banks will print into infinity? Read What to buy when the money printer goes brrrr

Up Next

Dec 12

preview