TLI - Deeper Investigation

TLI Performance Test from 1 Jan 2021 to June 2022:

Statistically significant p value < 0.001 for all sample sizes

The table above shows the hit rate, forward correlation pushed by 12 days, frequency and the number of TLI alerts generated from January 2021 to June 2022, across different TLI thresholds.

Overall, the TLI performs well on its entire domain: we see a 70% hit rate and a forward correlation of 42% even at the lowest threshold (0.0).

For the experiment, the bounds were decided as a function of hit rate, forward correlation, and frequency. Specifically, we wanted to maximise all three variables, which you can think of as accuracy, magnitude proportionality, and number of days when an alert was generated. You can see that we find diminishing marginal returns once we cross the threshold of 0.15 to 0.2, where the hit rate slightly increases (by 5%), but we lose significantly more TLI alerts - meaning the next threshold did not add as much of a benefit as the previous threshold.

Why weren’t bounds of 0.1 chosen?

Although we found a slightly higher hit rate at bounds of 0.1, our back test data found that incorrect instances were more frequent – in other words, even though they were marginally rarer, absolute losses were worse at that bound (which translates to worse performance).

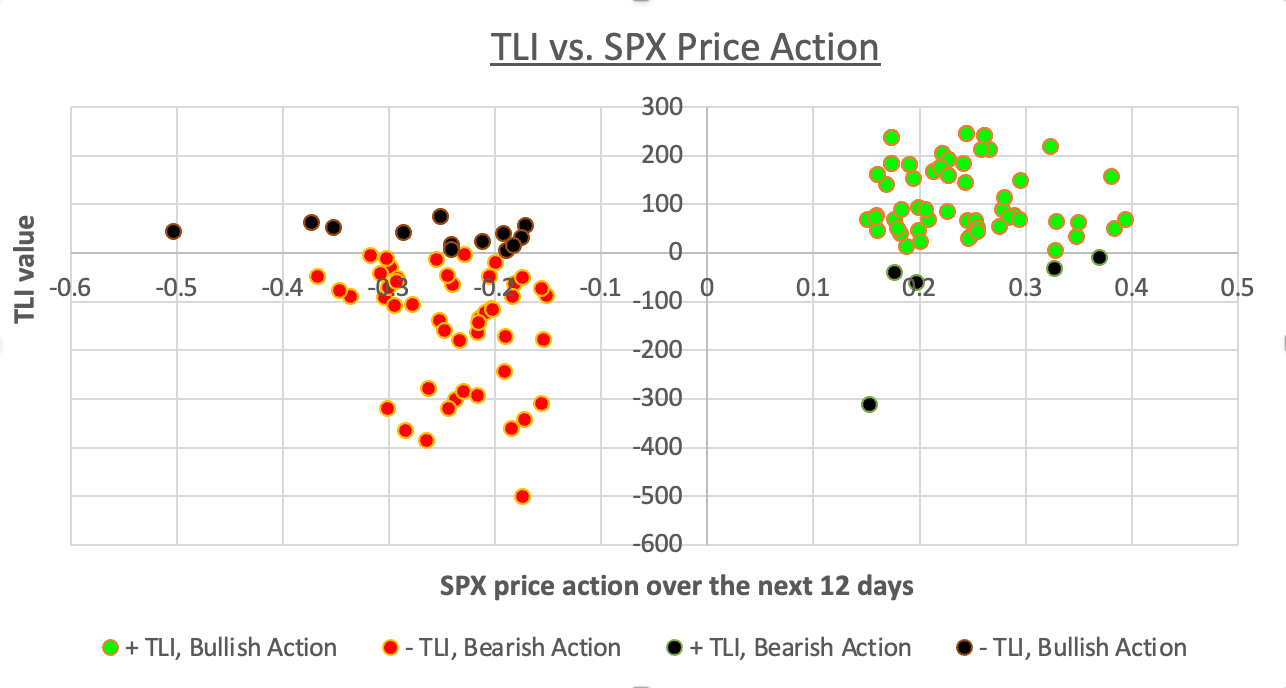

Does the TLI work better in bearish or bullish markets?

As we can see from Graph 2, the TLI has historically performed better with its bullish alerts; nevertheless, we can see that bearish alerts still outperform the SPX, by comparing the # of ‘correct’ points in Quadrant III and ‘wrong’ points in Quadrant II.